- About

-

Advocacy

- Submit Legislative Proposals to the ILA Public Policy Committee

- Advocacy Policies and Procedures

- More Than a Building

- Census 2020 Resources

- Creating or Changing Illinois State Library Law

- Illinois Minimum Wage Resources

- Intro to Property Taxes for IL Libraries

- ILA Public Policy Principles

- Legislative Issues

- Libraries and Immigration Enforcement

- Making Your Case

- Ready, Set, Advocate

- TIFs and Public Library Districts in Illinois

- Top Ten Advocacy Tips

- Unite Against Book Bans in Illinois

-

Committees

- Frequently Asked Questions (FAQ) about ILA Committees

- Advocacy Committee

- Awards Committee

- Conference Program Committee, 2025

- Conference Program Committee, 2026

- Diversity Committee

- Finance Committee

- Fundraising Committee

- ILA Reporter Advisory Committee

- Illinois Libraries Present Committee

- Illinois Public Library Standards Committee

- Intellectual Freedom Committee

- iREAD Committee

- Nominating Committee

- Public Policy Committee

- Reaching Forward North Committee

- Reaching Forward South Committee

- Events

-

Forums

- Frequently Asked Questions (FAQ) about ILA Forums

- Human Resources & Administration Forum (HRAF)

- Illinois Association of College & Research Libraries Forum (IACRL)

- Library Trustee Forum (LTF)

- Marketing Forum (MF)

- Resources & Technical Services Forum (RTSF)

- Retired Members Forum

- Small and Rural Libraries Forum (SARL)

- Students and New Professionals Forum (SANP)

- Young Adult Services Forum (YASF)

- Youth Services Forum (YSF)

- Initiatives

- Membership

- Publications

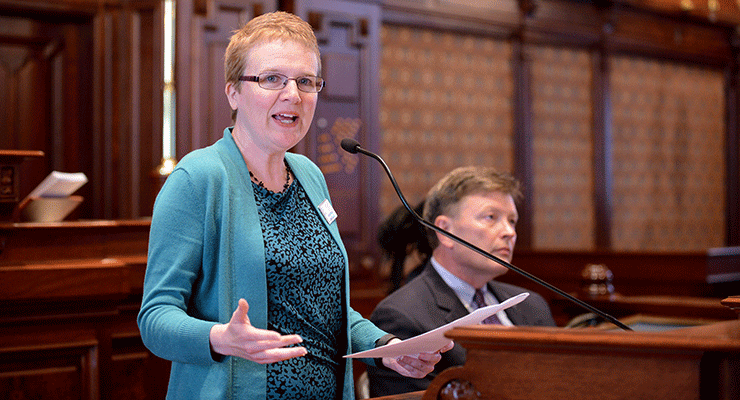

Tweet and Retweet: ILA President Does Stellar Job Testifying Against Property Tax Freeze

June 11, 2015

ILA President Jeannie Dilger presented testimony on June 9 to the full Illinois Senate opposing property tax proposals that would limit local library funding.

State Sen. Andy Manar tweeted: Wow. Quote of the Day from Jeannie Dilger: "A property tax freeze will do my employees no good if I have to lay them off."

ILA is taking the threat of a Springfield imposed permanent local property tax freeze very seriously. As the Illinois General Assembly and Governor Bruce Rauner consider unpopular state tax increases to balance their budget, they will be eager to boast that they limited local property taxes. The truth is that local property taxes are high primarily because the state has not fulfilled its financial obligations to schools and other local governments. Please remind your local State Senators and State Representatives that a local property tax freeze will do nothing to balance the state budget but will further cripple local services!

Full text of Jeannie Dilger's testimony to the Illinois Senate

Testimony

Freezing Property Taxes in Illinois

Tuesday, 9 June 2015, noon

Illinois Senate Chamber Capitol Good Afternoon, thank you for the opportunity to testify today on tax caps and the proposal to permanently freeze local government property tax levies. My name is Jeannie Dilger, I am the current President of the Illinois Library Association, which has over 3,000 members from across Illinois, including professional librarians, local library trustees, and library staff, local public and school libraries, academic institutions, and a variety of other library related institutions. I am also the Director of the La Grange Public Library. Perhaps most importantly for this hearing, my library is a tax capped library and has been since 1995.

Tax Caps were first imposed in 1991 to non-home rule local governments in DuPage, Kane, Lake, McHenry, and Will Counties. Tax caps were extended to Cook County in 1995, and the following year all Illinois county boards were given the option of placing a referendum on the ballot asking whether tax caps should apply in their county. Currently tax caps apply to almost 300 local public libraries.

Tax caps restrict an increase in the tax levy from year to year by the lesser of inflation or 5%. Under this law and the current level of inflation, my library cannot increase our levy by more than current CPI above the previous year. Public libraries get on average 98% of our funding from local property taxes. While our park districts can charge program fees, and our villages gain revenue through other sources such as sales tax, we have no authority to charge programmatic or user fees, and indeed such fees would be counter to our most basic mission to provide free access to the public.

Why would a public library need additional revenue from one year to the next? Simply put, costs rise. Every year it costs more to buy library materials, pay staff wages and required benefits, fix the boiler and repair the roof. However, library costs rise more than mere inflation because we are technology and service dependent. Adopting new technology and increasing access to expensive resources is absolutely central to our mission. Gas prices are low, but we don’t buy a lot of gas, we acquire digital and human knowledge; incredibly valuable and expensive.

For many Illinois residents, public libraries are a haven for exploring their lifelong love of learning with free access to lifesaving health information, life-changing education and career opportunities. Children across the state eagerly push through the doors of their neighborhood libraries for afterschool activities, help with homework and exciting literacy activities. These libraries are a fact of life, taken for granted by most residents.

Even more difficult is the fact that when the economy suffers, library demand increases. When our residents are hurting, the unemployed, especially our veterans, need help to prepare for and find jobs. When school funding is cut, students turn to us for homework assistance and help getting into college. When families can’t afford to go to the movies or buy a book, they use our downloadable books and streaming media.

What have tax caps already done to local libraries? Based on a survey of our libraries, 25% of respondents said tax caps forced a cut to hours of service; 47% were forced to reduce book and other material acquisition budgets, 28% were forced to lay off staff or reduce staff hours; and 15% were forced to cut internet connectivity or reduce access to new technology.

It is crucial to note that some costs cannot be avoided. We must make state mandated pension payments regardless of the limits imposed by tax caps. As the revenues are restricted and our mandated costs go up, we have no choice but to cut materials, programs, services, and people. Of those, my biggest concern is the people. Many libraries have already cut programs and materials to the bone. We are at a point where the only thing left to cut is the staff. As we strive to pay a living wage, we will be unable to support current levels of staffing. Over 50% of my staff live in the community they serve, and that is true of many public libraries. Freezing their property taxes will do them no good if they are unemployed.

If the General Assembly were to impose tax caps on the entire state, these same consequences would spread statewide. If the General Assembly were to impose a property tax freeze there is simply no way local libraries could continue to provide necessary service to our residents.

Our local public library trustees live and work in the community. They are best suited to manage the finances of the library, and are in the best position to respond to our local residents. Trustees give their personal time to serve the community, and local voters always have the option of voting elected trustees or the Mayors who appoint them out of office.

In La Grange, the Village trustees are considering a local property tax freeze for the 2015 levy. They are utilizing water and sewer bills to make needed sewer repairs, and residents voted to raise the sales tax less than 1% to accommodate increased downtown visits from nearby communities. However, those Village trustees recognize that the Library has no other source of income, and they still plan to request the maximum allowed increase under the tax cap for the Library to be able to keep up with increasing costs. To me, this is just one example of how trustees of a local village or town can make the best decisions for their residents, based on the needs of that particular community.

I appreciate the opportunity to present testimony today and urge the General Assembly to oppose the expansion of tax caps and especially oppose a one size fits all statewide property tax freeze. Thank you, and I would be happy to answer any questions.

iREAD Summer Reading Programs

iREAD Summer Reading Programs Latest Library JobLine Listings

Latest Library JobLine Listings